Wise

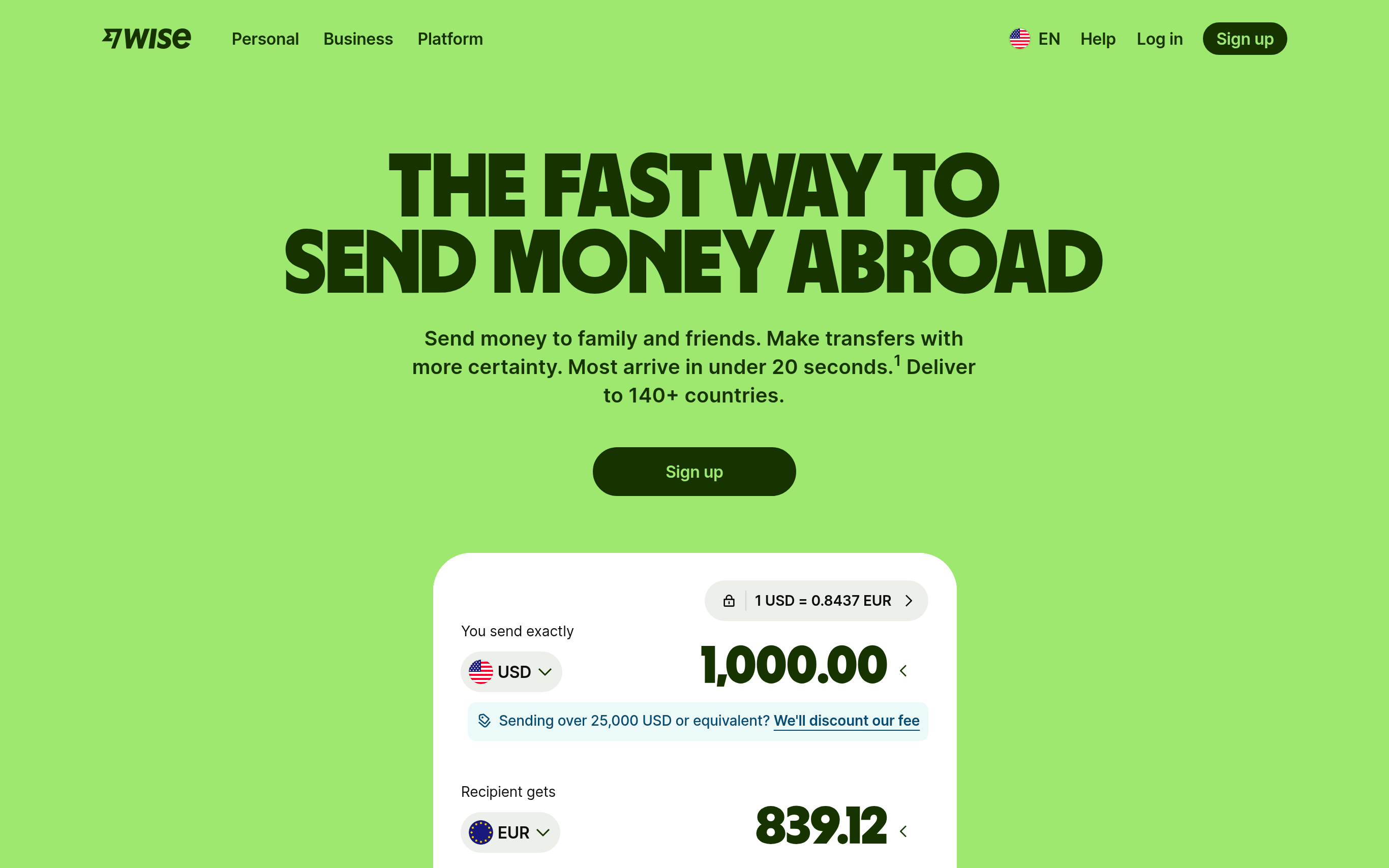

Wise is a global money transfer service that allows users to send, receive, and manage money internationally with minimal fees and maximum transparency. Unlike traditional banks that inflate exchange rates, Wise offers real mid-market rates, ensuring customers know exactly what they are paying for each transaction. With services tailored for both individuals and businesses, the platform supports over 40 currencies and promises quick transfers, with the majority arriving in under 20 seconds. Wise is trusted by millions, processing $16 billion each month, with robust security measures and regulatory compliance that safeguard customer funds.

Basic Capabilities :

Fair Exchange Rates, Instant Transfers, Multi-Currency Accounts, Security and Regulation, Easy Mobile Access

Basic Capabilities :

Fair Exchange Rates, Instant Transfers, Multi-Currency Accounts, Security and Regulation, Easy Mobile Access

GOOD FOR

PERSONAL: Individual users include travelers, expatriates, and anyone sending money internationally, benefiting from low fees and quick transfers that save time and money.

BUSINESS: Companies, including freelancers and SMEs, rely on Wise for efficient financial operations, using its multi-currency capabilities to manage payments and cash flow across borders effectively.

BUSINESS: Companies, including freelancers and SMEs, rely on Wise for efficient financial operations, using its multi-currency capabilities to manage payments and cash flow across borders effectively.

FEATURES

FAIR EXCHANGE RATES: Wise guarantees mid-market exchange rates without hidden fees, allowing users to save significantly on every transaction.

INSTANT TRANSFERS: The platform boasts an average transfer speed where 70% of transactions complete in under 20 seconds, making it one of the fastest options available.

MULTI-CURRENCY ACCOUNTS: Users can hold and manage money in over 40 currencies, enabling easy international transactions and reducing conversion fees.

PERSONALIZED GLOBAL ACCOUNT DETAILS: Receive payments easily in foreign currencies with unique local bank details for various countries, streamlining your financial interactions.

SECURITY AND REGULATION: Wise operates under 65 licenses worldwide, ensuring compliance and protection for user funds in safeguarded accounts.

BUSINESS FRIENDLY: Designed for enterprises, Wise offers business accounts that support seamless international payments and receiving in multiple currencies.

EASY MOBILE ACCESS: The Wise app allows users to manage their accounts and execute transactions on the go, making financial management convenient and accessible.

TRANSPARENCY: Full display of fees and transfer costs ensures that customers are never blindsided by hidden charges, promoting trust in every transaction.

INSTANT TRANSFERS: The platform boasts an average transfer speed where 70% of transactions complete in under 20 seconds, making it one of the fastest options available.

MULTI-CURRENCY ACCOUNTS: Users can hold and manage money in over 40 currencies, enabling easy international transactions and reducing conversion fees.

PERSONALIZED GLOBAL ACCOUNT DETAILS: Receive payments easily in foreign currencies with unique local bank details for various countries, streamlining your financial interactions.

SECURITY AND REGULATION: Wise operates under 65 licenses worldwide, ensuring compliance and protection for user funds in safeguarded accounts.

BUSINESS FRIENDLY: Designed for enterprises, Wise offers business accounts that support seamless international payments and receiving in multiple currencies.

EASY MOBILE ACCESS: The Wise app allows users to manage their accounts and execute transactions on the go, making financial management convenient and accessible.

TRANSPARENCY: Full display of fees and transfer costs ensures that customers are never blindsided by hidden charges, promoting trust in every transaction.

PRICING

FREE: Users can transfer money without any monthly fees, though standard transaction costs apply with real-time transparency of those fees before transfer.

INDIVIDUAL: For regular users, transfers to international accounts come with competitive fees starting from about 0.5%, depending on currency pairs, ensuring an economical way to send money.

BUSINESS: Wise offers pricing tailored for businesses, charging a fee per transaction, along with enhanced functionalities such as SSO/SAML integration and admin controls for team management.

ENTERPRISE: Custom pricing options for larger organizations include advanced security measures, compliance guarantees, and personalized account management to ensure governance over finances.

INDIVIDUAL: For regular users, transfers to international accounts come with competitive fees starting from about 0.5%, depending on currency pairs, ensuring an economical way to send money.

BUSINESS: Wise offers pricing tailored for businesses, charging a fee per transaction, along with enhanced functionalities such as SSO/SAML integration and admin controls for team management.

ENTERPRISE: Custom pricing options for larger organizations include advanced security measures, compliance guarantees, and personalized account management to ensure governance over finances.

TECHSTACK

MODEL – Wise utilizes advanced algorithms to optimize exchange rates and manage transactions efficiently across various currencies.

RUNTIME – The platform operates on a scalable infrastructure that guarantees high availability and quick processing speeds for all transactions.

DATA – Wise maintains real-time data access to currency exchange rates and transaction histories, enhancing transparency and user experience.

INTEGRATIONS – Supports integration with various banking systems and financial platforms, allowing seamless transactions and data synchronization.

API – Wise offers a robust API that allows third-party applications and businesses to integrate Wise’s functionalities directly into their solutions.

RUNTIME – The platform operates on a scalable infrastructure that guarantees high availability and quick processing speeds for all transactions.

DATA – Wise maintains real-time data access to currency exchange rates and transaction histories, enhancing transparency and user experience.

INTEGRATIONS – Supports integration with various banking systems and financial platforms, allowing seamless transactions and data synchronization.

API – Wise offers a robust API that allows third-party applications and businesses to integrate Wise’s functionalities directly into their solutions.

last update : February 2, 2026